New survey data has emerged over the last couple years that gives advisors a better sense of who these millennials are and what they care about. It is especially interesting to see how millennials view their finances and financial plan post-COVID (after March 2020). We’ve extracted some of the key highlights from these surveys and condensed them into five major take-aways below.

1. For many millennial parents, their financial future is a primary source of stress even though they are responsible and plan ahead.

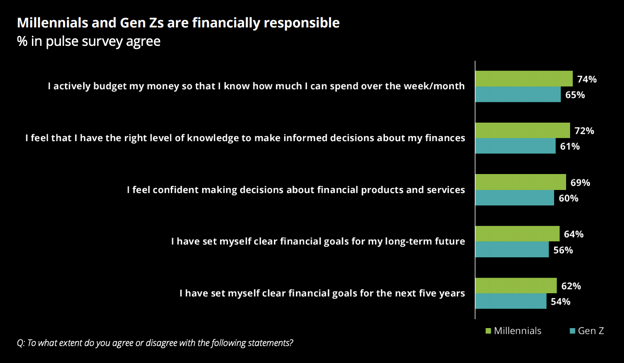

Millennials are often stereotyped as entitled and fiscally irresponsible, but the Deloitte Global Millennial Survey from 2020 indicates something else entirely. Conducted both before the pandemic and post-COVID during the summer of 2020, millennials were asked a series of questions across a broad spectrum of different issues and challenges. One of the major categories dealt with millennials and their finances.

According to the survey questions asked in the midst of the pandemic (Summer 2020), a majority (64%) of millennials agreed with the statement, “I have set myself clear financial goals for my long-term future” and 62% have “set clear financial goals for the next 5 years.” It is also worthy to note that more than ⅔ of millennials (72%) believe they have the “right level of knowledge to make informed decisions about their finances.” These answers paint a picture of a financially responsible group where the majority of participants understands the importance of planning for the future.

Credit: Deloitte Global Millennial Survey 2020

Credit: Deloitte Global Millennial Survey 2020

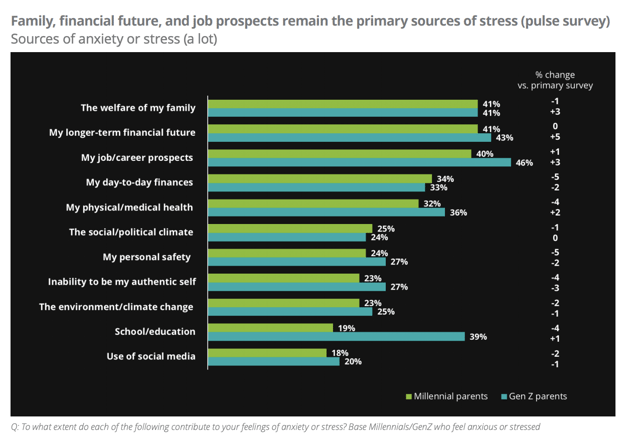

At the same time, in the same exact survey, 41% of millennial respondents listed their “longer-term financial future” as a major source of anxiety or stress. This was one of the top 2 highest scoring statements, equivalent to “welfare of my family,” for all the millennial participants.

Credit: Deloitte Global Millennial Survey 2020

Credit: Deloitte Global Millennial Survey 2020

Financial advisors should be encouraged by these survey results in their pursuit of partnerships with millennial clients. Most millennials know the value of a well-formulated financial plan and could greatly benefit from an advisor’s expertise in developing a personalized fiscal roadmap.

Advisors can also use this information to better demonstrate empathy in their conversations with millennial clients. While most millennials do not have the high-level of expertise that a financial advisor can provide, more than ⅔ of these respondents believe they have enough information to make sound decisions. Furthermore, finances are a high source of stress for many clients in this group. The advisor should look to tread lightly and listen first in forming a trusting relationship before gently offering adjustments to already established plans. Seek first to help educate about the process, and millennials will be more open to your advice down the road.

2. More millennials are interested in receiving financial advice post-COVID.

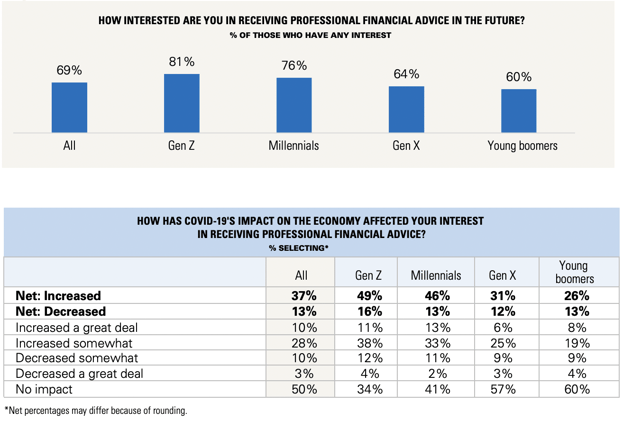

Financial advisors can learn from another survey conducted by Vanguard in May 2020 which surveyed 1,578 individuals during the COVID-19 pandemic, including 885 millennials.

At the time of the survey, 56% of the millennials questioned have never received professional financial advice, but 76% of respondents say they are interested in receiving professional financial advice in the future. For many millennials, the pandemic experience has changed their perspective on the need for financial expertise: 46% say that COVID-19’s impact on the economy has increased their interest in receiving professional financial advice.

Credit: Vanguard Digital Advisory Survey 2020

Credit: Vanguard Digital Advisory Survey 2020

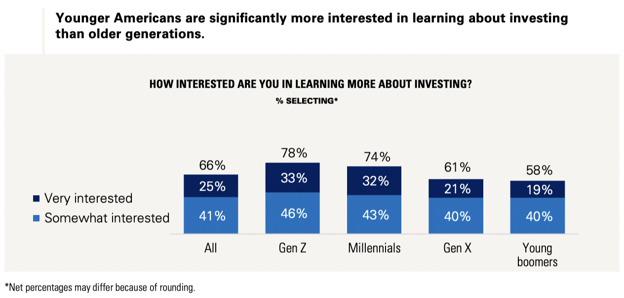

Along the same line of questioning, millennials also showed more interest in learning about investing than the Gen X or Young Boomer subgroups. 74% of millennial respondents affirmed their desire to learn more about investing.

Credit: Vanguard Digital Advisory Survey 2020

Credit: Vanguard Digital Advisory Survey 2020

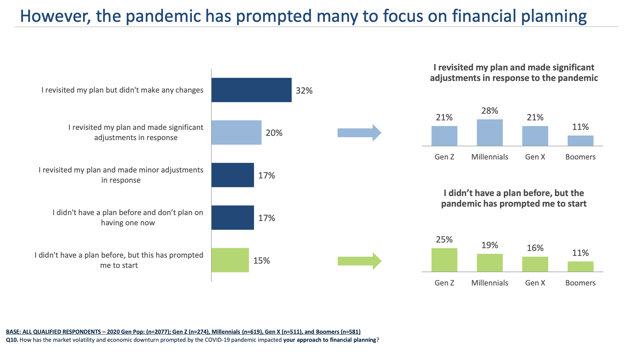

Upon review of a third survey taken after the start of the global pandemic, Northwestern Mutual’s Planning and Progress Survey 2020, we saw similar trends in the responses for millennials. As a result of the pandemic, 28% of millennials were prompted to revisit their financial plan. 19% of respondents had no financial plan, but the pandemic prompted them to start developing one.

Credit: Northwestern Mutual’s Planning and Progress Survey 2020

Credit: Northwestern Mutual’s Planning and Progress Survey 2020

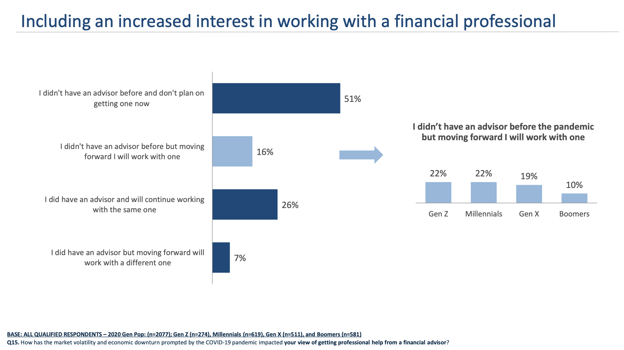

As far as working with a professional financial advisor is concerned, just like in the Vanguard results, 22% of millennial respondents on the Northwestern Mutual survey stated that they didn’t have a financial advisor prior to the pandemic, but will work with one moving forward.

Credit: Northwestern Mutual’s Planning and Progress Survey 2020

Credit: Northwestern Mutual’s Planning and Progress Survey 2020

There is no question that millennials are seriously interested right now in discussing investment options and how to best manage their finances into the future. Financial advisors should take note.

3. Most millennials will be paying off student loans soon.

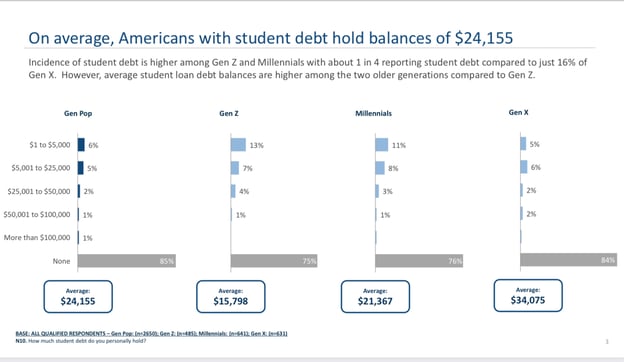

An analysis of Northwestern Mutual’s Planning and Progress Survey 2020 uncovered important information about millennials and their student loan debt situations. Much is made about the rising debt costs for students attending colleges in the United States, but it is worth digging through some of the specifics in more detail.

At the time of this survey late 2020, the average millennial student loan debt was $21,367. While significant, most of this student loan debt is carried by a small percentage of the group. 76% of millennials have no student loan debt at all. Of the rest of the millennial population who do still carry student loan debt, it is not as much as what might be imagined. Only 8% of respondents carry student loan debt amounts between $5,001 - $25,000. 11% only have between $1 - $5,000.

Credit: Northwestern Mutual’s Planning and Progress Survey 2020

Credit: Northwestern Mutual’s Planning and Progress Survey 2020

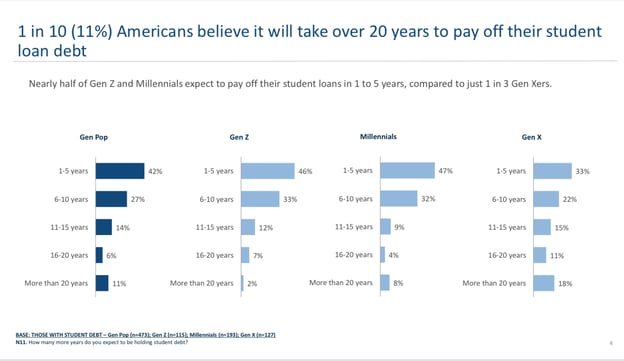

While pockets of millennials do have student loan debt of various amounts, 47% of millennials plan to pay off their loans completely in the next 1-5 years. For about half of the respondents who still do have student loans, there is certainly light at the end of the tunnel!

Credit: Northwestern Mutual’s Planning and Progress Survey 2020

Credit: Northwestern Mutual’s Planning and Progress Survey 2020

In thinking about how to expand and diversify your client base, financial advisors should not be deterred by student loan debt. As shown above, the majority of millennials do not have any student loan debt to begin with, and for many it will cease to be an issue soon.

4. Millennials view retirement much differently than previous generations.

Financial advisors need to know how millennials view retirement and how it differs from previous generations. It could drastically change how you approach your initial conversations with members of this subgroup.

The first key takeaway is that millennial retirement accounts have not been significantly impacted by the COVID-19 pandemic. On the Vanguard survey, only 1 in 10 millennials have canceled or postponed retirement account contributions. While only 10% have decided to postpone regular retirement payments, 98% are not planning to delay their retirement due to the pandemic.

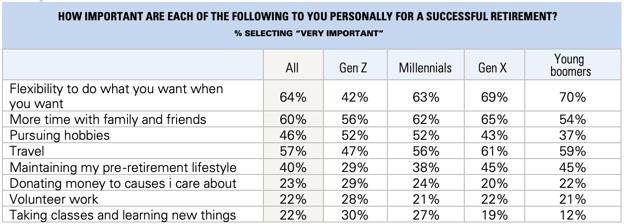

According to the same survey, 63% of millennials associate retirement with true flexibility: being able to do what they want when they want. Flexibility may be valued so highly because most millennials do not plan to stop working once they “retire.” 39% are planning to use the flexibility of retirement to start a new career, and 35% want to start their own business.

Credit: Vanguard Digital Advisory Survey 2020

Credit: Vanguard Digital Advisory Survey 2020

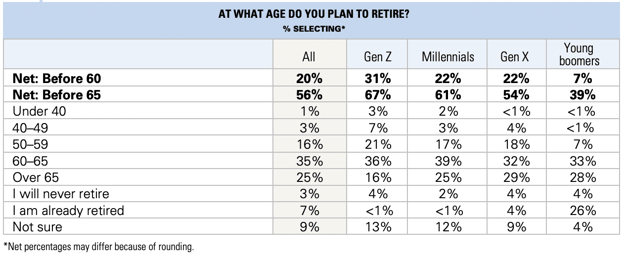

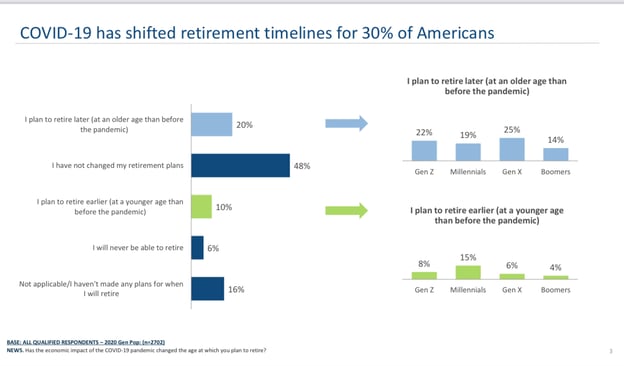

The third highlight of these surveys is the planned age of retirement for most millennials. The Vanguard survey reports that 61% want to retire before age 65 and over a fifth (22%) are seeking retirement prior to age 60. These are much higher percentages compared to Gen X and Young Boomer older generations. The Northwestern Mutual Planning and Progress survey affirms these key points: 15% of millennial respondents are actually planning to retire earlier due to the pandemic. This is the highest percentage of any subgroup recorded in the data results.

Credit: Vanguard Digital Advisory Survey 2020

Credit: Vanguard Digital Advisory Survey 2020

Credit: Northwestern Mutual’s Planning and Progress Survey 2020

Credit: Northwestern Mutual’s Planning and Progress Survey 2020

What to take away as a financial advisor? Millennials don’t equate retirement with packing up their bags and leaving the workplace. Instead, it’s a means to an end for pursuing other careers and lines of work that speak to their passions and desires. When partnering with millennials, be prepared to talk about an aggressive approach to retire early and invest accordingly.

5. Millennials care deeply about the integrity of their financial advisor.

A pre-pandemic 2019 Investopedia Millennial Survey brings us what might be the most interesting and important takeaway from our data analysis. Affluent millennials care more about the integrity and trustworthiness of their financial advisors than anything else. It’s not even close.

When asked, “What is the most important quality of an advisor?” affluent millennials ranked “honesty,” “trustworthy,” and “has best interests in mind” as the top three qualities. These were significantly higher than the performance or achievement oriented qualities offered as selections.

While financial security and performance is important, millennials want someone who will be honest with them. Someone they can trust to give advice that puts them in the best position to take care of their family.

For financial advisors looking to partner with millennials, we recommend emphasizing trust and relationship building as a top priority in your messaging, particularly if you are a fiduciary. Make sure millennial clients understand the ins and outs of every decision, particularly if certain parts of the plan have risks. Transparency is the key to success.

Pro Tip:

Looking to refine your messaging to attract millennials or other groups to diversify your client base? Check out our post on attracting right fit advisors to your practice to learn more about how to articulate your brand and messaging strategy.

If you haven’t started thinking about how your practice can attract and partner with millennials, now is the time. The COVID-19 pandemic has expedited the need for financial planning in the minds of many members of the millennial subgroup. They are ripe for and ready to partake in the benefits offered by you and your business.

Looking to talk about this and other ways to partner with millennials? Set up a consultation with us here.